The Employees’ Provident Fund (EPF) Scheme is a vital retirement savings plan tailored for salaried employees in India (EPFO login). It is managed by the Employees’ Provident Fund Organisation (EPFO), which operates under the Ministry of Labour and Employment. This scheme helps employees accumulate a portion of their salary each month, along with an equal contribution from their employer, to build a substantial fund for their retirement.

On this Website , you will find comprehensive information about various aspects of the EPF scheme. We cover everything you need to know about checking your EPF balance, accessing your EPF passbook, tracking your claim status, and updating your KYC details. Additionally, you can learn how to submit online claims for withdrawing your PF amount and understand the UAN (Universal Account Number) login process. Our goal is to make managing your EPF account as simple and accessible as possible.

EPFO Login

The Employees’ Provident Fund Organisation (EPFO) provides a range of online services to help employees manage their Provident Fund (PF) accounts with ease. One of the most important features is the EPFO login, which allows members to access their accounts, check their EPF balance, download their passbook, and manage various aspects of their retirement savings online.

What You Need to Log In

To access your EPF account online, you will need the following:

- Universal Account Number (UAN): This is a unique 12-digit number assigned to each EPF member. It is essential for accessing your EPF account, and it remains the same throughout your career, even if you change jobs.

- Password: The password is set during the registration process on the EPFO portal. If you haven’t set up a password yet, or if you’ve forgotten it, you can reset it using your UAN and registered mobile number.

Steps to Log In

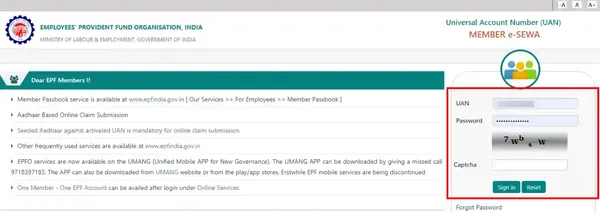

- Visit the EPFO Portal: Go to the official EPFO website https://www.epfindia.gov.in.

- Navigate to the UAN Member e-Sewa: On the homepage, look for the “For Employees” section and click on the “UAN Member e-Sewa” link.

- Enter Your Details: On the login page, enter your UAN, password, and the captcha code displayed on the screen.

- Click Login: After entering your details, click on the “Sign in” button to access your EPF account.

Services Available After Login

Once logged in, you can access a wide range of services, including:

- Checking EPF Balance: View your current EPF balance, including contributions from you and your employer.

- Downloading the EPF Passbook: Download a detailed statement of your EPF account, showing all transactions, including monthly contributions and interest earned.

- Updating KYC Details: Ensure your account details are up-to-date by linking your Aadhaar, PAN, and bank account information.

- Submitting Online Claims: Apply for partial withdrawals or full settlement of your EPF account online.

- Tracking Claim Status: Check the status of any claims you have submitted, such as withdrawals or transfers.

EPF Passbook And Claim Status

To manage your EPF login account effectively, it’s important to understand how to access your EPF passbook and track your claim status.

EPF Passbook

The EPF passbook is a digital document that contains a detailed record of all contributions made to your EPF account, including those from both the employee and employer. It also shows the interest earned on these contributions over time. The passbook is an essential tool for keeping track of your savings and ensuring that your employer is regularly depositing the correct amount into your EPF account.

How to Access Your EPF Passbook:

- Visit the EPFO Portal: Go to the official EPFO login website https://www.epfindia.gov.in.

- Log In to UAN Member e-Sewa: Use your Universal Account Number (UAN) and password to log in to the UAN Member e-Sewa portal.

- Download the Passbook: After logging in, navigate to the “Download” section and select “Passbook.” You can then view or download your EPF passbook for reference.

The passbook provides a comprehensive overview of your account, including monthly contributions, withdrawals (if any), and the balance accumulated in your EPF account.

EPF Claim Status

If you’ve submitted a claim for withdrawal, transfer, or any other EPF-related service, it’s important to keep track of the claim status to know where it stands in the processing cycle.

Steps to Check EPF Claim Status:

- Visit the EPFO Portal: Access the official EPFO login website https://www.epfindia.gov.in.

- Go to the ‘Track Claim Status’ Section: You can find this option either under the “For Employees” section or directly on the UAN Member e-Sewa dashboard.

- Enter UAN and Captcha: You’ll need to enter your UAN and the security captcha to proceed.

- View Claim Status: Once you’ve logged in, you’ll be able to see the status of your current and past claims, including whether they are pending, in process, or settled.

Why These Features Matter

- Transparency: The EPF passbook allows you to verify that your employer is making regular contributions and that your savings are growing as expected.

- Convenience: Checking your claim status online saves you time and provides peace of mind, knowing exactly where your request stands.

- Planning: By keeping track of your EPF balance and claim status, you can better plan your finances, whether you’re nearing retirement, considering a job change, or facing an emergency that requires partial withdrawal.

Member KYC on EPFO Portal

Member KYC: Keeping Your EPF Account Updated

In the Employees’ Provident Fund (EPF) system, “KYC” stands for “Know Your Customer.” It is a process that helps keep your EPF account accurate and safe by linking it to your important personal documents like your Aadhaar number, PAN (Permanent Account Number), and bank details.

What is Member KYC?

Member KYC is about making sure your EPF account has all the correct information about you. This includes your identity, address, and bank details. Updating your KYC details is important for several reasons:

- Smooth Transactions: With updated KYC, you can easily withdraw money from your EPF account, transfer your balance when you change jobs, and receive benefits without any trouble.

- Account Security: KYC helps protect your EPF account from unauthorized access by ensuring that only you can access it.

- Government Rules: The EPFO requires KYC updates to follow government rules and make sure your money goes directly to your bank account.

How to Update Your KYC Details

You can update your KYC details online through the UAN Member e-Sewa portal. Here’s how:

- Log In to UAN Member e-Sewa: Go to the EPFO login website https://www.epfindia.gov.in and log in with your Universal Account Number (UAN) and password.

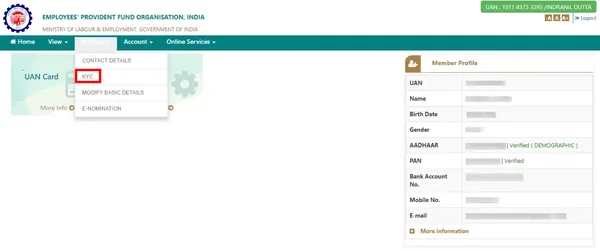

- Go to the ‘KYC’ Section: After logging in, find the “Manage” tab and click on “KYC.”

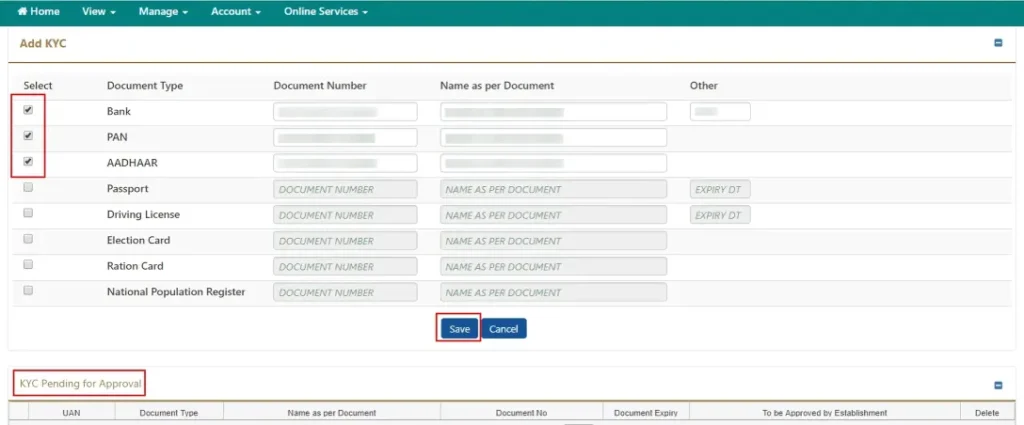

- Enter Your Details: You will see options to add your Aadhaar, PAN, bank account details, and more. Enter the required details and upload any needed documents.

- Save and Submit: Once you’ve added all the details, click “Save” to submit them. Your employer will need to approve these details before they are updated in your account.

- Check KYC Status: You can check if your KYC details are approved on the same portal. Once approved, the status will show as “Verified.”

Why KYC is Important

- Easy Access to Services: Without updated KYC, you may not be able to use all the online EPF services, like checking your balance or filing claims.

- Quick Withdrawals: With KYC, your withdrawals are processed faster and directly sent to your bank account.

- Smooth Job Changes: If you switch jobs, having your KYC updated ensures that your EPF account can be easily managed under your new employer.

Steps to claim EPF online ( EPF withdraw)

Step 1: Log in to the UAN Member Portal

- Go to the EPFO website: https://www.epfindia.gov.in.

- Click on “For Employees” and select “UAN Member e-Sewa.”

- Log in using your Universal Account Number (UAN), password, and captcha code.

Step 2: Verify KYC Details

- Ensure that your KYC details (Aadhaar, PAN, and bank details) are updated and verified.

- This is necessary for processing your withdrawal request.

Step 3: Access the Claim Section

- Once logged in, navigate to the “Online Services” tab.

- Select “Claim (Form-31, 19 & 10C)” from the dropdown menu.

Step 4: Verify Your Member Details

- Your personal details will be displayed on the screen.

- Check that your name, date of birth, and other information are correct.

Step 5: Confirm Bank Account Details

- Enter the last four digits of your bank account linked to your EPF account.

- This is to confirm the account where your withdrawal amount will be deposited.

Step 6: Choose the Type of Withdrawal

- A new page will open with different withdrawal options:

- Final Settlement (Form 19): For full withdrawal after leaving the job.

- Partial Withdrawal (Form 31): For specific needs like medical emergencies or home purchase.

- Pension Withdrawal (Form 10C): For withdrawing pension benefits.

- Select the appropriate option for your situation.

Step 7: Fill in Details and Upload Documents

- Provide any additional details required based on the type of withdrawal.

- Upload any necessary documents if prompted.

Step 8: Submit the Withdrawal Request

- Click “Get Aadhaar OTP.”

- An OTP will be sent to your registered mobile number linked with your Aadhaar.

- Enter the OTP and submit your withdrawal request.

Step 9: Track Your Claim Status

- After submission, you can track the status of your claim.

- Go to the “Track Claim Status” option under the “Online Services” tab to check the progress.

By following these steps, you can easily withdraw your EPF amount online.

What is EPF ( Employees Provident Fund)

EPF (Employees’ Provident Fund) is a savings scheme designed for salaried employees in India. It is managed by the Employees’ Provident Fund Organisation (EPFO), which operates under the Ministry of Labour and Employment. The primary goal of EPF is to help employees save a portion of their salary for retirement, creating a financial safety net for their future.

How EPF Works:

- Contributions: Both the employee and the employer contribute to the EPF account. Typically, 12% of the employee’s basic salary and dearness allowance is deducted each month as the employee’s contribution, and an equal amount is contributed by the employer.

- Interest: The contributions made to the EPF account earn interest at a rate determined by the government each year. This interest accumulates over time, adding to the employee’s savings.

- Retirement Savings: The total amount saved in the EPF account, including contributions and interest, is available to the employee upon retirement. It serves as a lump sum amount that can help meet financial needs after retirement.

Key Features of EPF:

- Universal Account Number (UAN): Each EPF member is given a unique UAN, which remains the same throughout their career, even if they change jobs. The UAN helps in managing multiple EPF accounts and makes it easier to transfer funds when switching employers.

- Partial Withdrawals: EPF allows partial withdrawals under certain conditions, such as for medical emergencies, home purchase, or education expenses. These withdrawals are allowed while the employee is still working.

- Tax Benefits: The contributions made by both the employee and employer, as well as the interest earned, are generally tax-exempt, making EPF a tax-efficient savings option.

- Pension Benefits: Along with the provident fund, EPF also includes a pension scheme (Employees’ Pension Scheme, or EPS), which provides monthly pension benefits to employees after retirement, based on their years of service and average salary.

Interest Rate of EPF

The interest rate for the Employees’ Provident Fund (EPF) is determined annually by the Employees’ Provident Fund Organisation (EPFO) in consultation with the Ministry of Labour and Employment. Below is a table showing the EPF interest rates for the last few years:

| Financial Year | EPF Interest Rate (%) |

|---|---|

| 2023-2024 | 8.15% |

| 2022-2023 | 8.15% |

| 2021-2022 | 8.10% |

| 2020-2021 | 8.50% |

| 2019-2020 | 8.50% |

| 2018-2019 | 8.65% |

| 2017-2018 | 8.55% |

| 2016-2017 | 8.65% |

| 2015-2016 | 8.80% |

| 2014-2015 | 8.75% |

What is EPFO ( Employees Provident Fund Organization)

EPFO stands for the Employees’ Provident Fund Organisation. It is a statutory body under the Ministry of Labour and Employment, Government of India. The primary role of the EPFO is to manage and oversee the Employees’ Provident Fund (EPF), a compulsory retirement savings scheme for employees working in the organized sector in India.

Key Functions of EPFO:

- Management of EPF Scheme:

- The EPFO administers the Employees’ Provident Fund Scheme, which requires both employees and employers to contribute a portion of the employee’s salary to the provident fund. This fund acts as a long-term savings tool for employees, helping them build a financial reserve for retirement.

- Employees’ Pension Scheme (EPS):

- EPFO also manages the Employees’ Pension Scheme, which provides pension benefits to employees after their retirement. The scheme ensures that employees have a steady income after they stop working.

- Employees’ Deposit Linked Insurance Scheme (EDLI):

- This scheme, also managed by the EPFO, provides life insurance coverage to employees covered under the EPF. It ensures that in case of an employee’s death while in service, their family receives a lump sum amount.

- Universal Account Number (UAN):

- EPFO issues a Universal Account Number (UAN) to every employee. This unique number remains constant throughout the employee’s career, making it easier to manage multiple EPF accounts across different employers. The UAN also facilitates easy transfers, withdrawals, and tracking of EPF balances.

- Compliance and Enforcement:

- EPFO ensures that employers comply with the provisions of the EPF & MP Act, 1952. It monitors and enforces the correct and timely deposit of contributions by employers.

- Online Services:

- EPFO has embraced digital transformation by offering various online services. Through the EPFO portal and mobile apps, employees can check their EPF balance, download their EPF passbook, update their KYC details, and submit claims for withdrawal or transfer of funds.

- Grievance Redressal:

- EPFO also handles grievances related to EPF accounts. Employees can lodge complaints online, and EPFO ensures timely resolution of these issues.

Importance of EPFO:

- Social Security: EPFO plays a critical role in providing social security to millions of workers in India. It ensures that employees have access to their savings during retirement and financial assistance during unexpected events like disability or death.

- Financial Management: The organization is responsible for managing the large corpus of funds accumulated from the contributions of millions of workers, ensuring that these funds are invested safely and earn interest.

- Welfare of Employees: EPFO’s schemes are designed to support the financial well-being of employees, offering them security and stability during their working life and after retirement.

EPFO Schemes And Services

The Employees’ Provident Fund Organisation (EPFO) administers several key schemes designed to provide financial security and benefits to employees in India. Here’s a detailed look at the main schemes under EPFO:

1. Employees’ Provident Fund Scheme (EPF)

- Purpose: The EPF Scheme is a mandatory savings plan for employees in the organized sector, aimed at building a retirement corpus.

- Contributions: Both the employee and employer contribute to the EPF account. Typically, 12% of the employee’s basic salary and dearness allowance are contributed by both parties. The entire employee’s contribution goes to EPF, while a portion of the employer’s contribution is allocated to the Employees’ Pension Scheme (EPS).

- Interest: Contributions earn interest at a rate declared annually by EPFO. The interest is compounded annually.

- Withdrawals: Employees can withdraw their EPF balance upon retirement, resignation, or after being unemployed for a specified period. Partial withdrawals are also allowed for specific purposes, such as medical emergencies or home purchases.

2. Employees’ Pension Scheme (EPS)

- Purpose: The EPS provides pension benefits to employees after retirement and to their families in case of the employee’s death.

- Contributions: A portion (8.33%) of the employer’s EPF contribution is diverted to the EPS. Employees do not contribute directly to EPS.

- Eligibility: To qualify for a pension, an employee must have completed at least 10 years of service. The pension typically begins at age 58, though early retirement is possible at a reduced rate from age 50.

- Pension Calculation: The monthly pension is calculated based on the employee’s average salary during the last five years of service and the total number of years of service.

3. Employees’ Deposit Linked Insurance Scheme (EDLI)

- Purpose: The EDLI scheme provides life insurance coverage to employees. In the event of an employee’s death while in service, the nominee or legal heir receives a lump sum payment.

- Contributions: Employers contribute 0.5% of the employee’s basic salary towards the EDLI scheme. Employees do not make any direct contributions.

- Insurance Benefit: The maximum insurance benefit under the EDLI scheme is up to ₹7 lakh, depending on the employee’s salary and the number of years of service.

4. Voluntary Provident Fund (VPF)

- Purpose: The VPF allows employees to contribute additional amounts voluntarily to their EPF account beyond the mandatory 12% contribution.

- Contributions: Employees can contribute up to 100% of their basic salary and dearness allowance to the VPF. The employer is not required to match these additional contributions.

- Interest: The VPF contributions earn the same interest rate as the EPF, making it a beneficial option for increasing retirement savings.

- Tax Benefits: VPF contributions qualify for tax deductions under Section 80C of the Income Tax Act, and the interest earned is tax-free.

5. Universal Account Number (UAN)

- Purpose: The UAN is a unique 12-digit number assigned to every EPF member, used to manage and consolidate multiple EPF accounts.

- Features: It simplifies the management of EPF accounts when changing jobs and facilitates easy access to EPF services. Employees can use their UAN to check their EPF balance, transfer accounts, and update KYC details online.

6. EPF Online Services

- Purpose: EPFO provides various online services through the UAN Member e-Sewa portal, enhancing convenience for members.

- Services: Employees can view and download their EPF passbook, update KYC details, file claims for withdrawals or transfers, and check the status of their claims online.

7. Employees’ Pension Scheme (EPS) Pension

- Purpose: Under the EPS, employees who have completed a minimum of 10 years of service are eligible for a monthly pension after retirement or upon attaining the age of 50 for early pension.

- Features: The pension amount depends on the average salary of the last five years of service and the total years of service. The scheme also provides pension benefits to the family in case of the employee’s death.

Frequently Asked Questions About EPFO Portal

What is EPFO, and what are its functions?

The Employees’ Provident Fund Organization (EPFO) is a statutory body under the Ministry of Labour and Employment, Government of India. It manages the Employees’ Provident Fund (EPF), a retirement benefits scheme for salaried employees in India. EPFO’s main functions include managing the provident fund, pension, and insurance schemes for employees, ensuring timely contributions from employers, and facilitating withdrawals and transfers of funds.

Who is eligible to become a member of EPFO?

Any employee earning a basic salary of up to ₹15,000 per month is eligible and automatically becomes a member of EPFO if their employer is covered under the EPF Act. However, employees earning above ₹15,000 can also become members with the employer’s and employee’s consent.

How can I check my EPF balance?

You can check your EPF balance through the EPFO portal using your Universal Account Number (UAN), via the EPFO mobile app, or by sending an SMS or giving a missed call from your registered mobile number. You can also check it on the UMANG app by linking your UAN.

What is a Universal Account Number (UAN)?

The Universal Account Number (UAN) is a 12-digit unique number assigned to each EPFO member. It serves as a single identifier for multiple Member Identification Numbers (Member IDs) allotted to an individual by different employers. The UAN remains the same throughout the employee’s career, regardless of job changes, making it easier to manage and access EPF accounts.

How can I withdraw money from my EPF account?

EPF withdrawal can be done online through the EPFO portal using your UAN and password. You need to fill out the online claim form, select the type of withdrawal (full, partial, or pension), and submit it. The money is usually credited to your bank account within a few days. Offline withdrawal can also be done by submitting a physical form to the EPFO office.

What are the tax implications on EPF withdrawals?

EPF withdrawals are tax-free if withdrawn after five continuous years of service. If withdrawn before five years, the amount is subject to tax, and the EPF contributions are taxed as per the individual’s income tax slab. However, withdrawals for specific reasons like medical emergencies or education are exempt from tax even within five years.

Can I transfer my EPF account when I change jobs?

Yes, when you change jobs, you can transfer your EPF account from the previous employer to the new one using the EPFO portal. The process requires your UAN, and the transfer can be initiated by logging into the EPFO member portal and submitting the transfer request online. The new employer will update the Member ID under the same UAN, ensuring continuity in your EPF contributions.